This chapter contains the following topics:

Setting Up Payroll Calculations

The Tax Tables selection enables you to define how the payroll software calculates federal, state, and city (or local) taxes.

You can define a federal tax code and one or more state codes, as well as one or more city (or local) codes.

You must enter the federal tax code and at least one state tax code. The payroll calculation functions assume that the federal tax code is defined and, since employee entry forces you to enter a state code, you must have entered at least one state tax code before entering employee information.

You can enter as many state and city (or local) tax codes as you require.

Such tax codes must be defined for each company whose payrolls you run using Passport Business Solutions Payroll.

The tax codes you enter here interact with other information contained in employee records during payroll calculation, which results in your being able to handle a wide variety of individual tax requirements on an employee-by-employee basis.

Since state tax requirements are quite volatile, there may be some tax situations that you cannot handle by simply entering an appropriate tax code record.

You may yet be able to handle such a situation by entering a type X deduction code, described in the Deductions/Earnings chapter, and then using it as a permanent deduction for the employees affected by it.

|

Note |

Tax Payables Tax amounts due are accumulated in Payroll but they are not paid to the taxing entity. If you are using PBS Accounts Payable, you may make a NON-A/P entry specifying the appropriate cash account and distributing the full amount to this liability account. |

When you set up your Tax Table entries, you will need to enter G/L account numbers in order to accumulate payroll tax expenses and liabilities. You can enter these numbers using your standard full account number format, as defined in Company Information. Or, you can also track tax expenses and liabilities by specifying a variable cost center (or sub account), if your account number structure includes cost centers (or sub accounts).

To set up a variable cost center (or sub account) in the tax account number field, press <F5> at the cost center (or sub account) position. Enter the main account number in the standard manner. When a check is posted, the cost center (or sub account) from the employee’s wage account will automatically be used. (Every employee has a wage account entered in the Employees selection.)

The variable account function works similarly for cost centers or sub accounts. As a simple example of the variable account function, assume that the account number structure consists of main and sub accounts. A wage account for an employee is 6010-100 (main-sub).

Assume also that the Federal tax liability main account number is 2100. You wish to vary the Federal tax liability account by the individual employee’s sub account. When you set up the Federal tax table, press <F5> at the sub account entry position of field 5. Tax liab acct #. The sub account field will then display on the screen as 2100- ~~~* Sub Accts vary w/employee *. This sets up the variable account function so that when you post Payroll checks, the accounting distribution for the tax liability will be posted to account 2100-100 for this employee. If another employee’s wage account is 6010-200, the distribution for this employee would post to account 2100-200.

If you are using cost centers, and your cost center has two segments, you can press <F5> in either segment. Pressing it in the first segment makes both segments variable. Pressing it in the second segment makes only the second segment variable. There is no way to make the first segment variable without making the second variable also.

Some account fields allow an <SF5> option as well as <F5>. What this does is make the entire account number variable; that is, the whole account number is picked up at posting time from the employee’s wage account.

Federal and State Tax Code Fields

The Federal tax code account fields affected by this are summarized below:

| Character field number | Federal tax table field name |

|

5. |

Tax liab acct # |

|

17. |

Empr soc sec exp acct |

|

18. |

Empr soc sec liab acct |

|

19. |

Emp soc sec liab acct |

|

23. |

Empr medicare exp acct |

|

24. |

Empr medicare liab acct |

|

25. |

Emp medicare liab acct |

|

28. |

FUI expense account # |

|

29. |

FUI liability account # |

|

31. |

Vacation pay exp acct # (Allows <SF5>) |

|

32. |

Holiday pay exp acct # (Allows <SF5>) |

|

33. |

Sick pay exp acct # (Allows <SF5>) |

|

35. |

Loan repayment acct # |

|

36. |

Garnish liability acctState Tax Code |

| State tax table field name | |

|

5. |

Tax liab acct # |

|

29. |

SUI expense account # |

|

30. |

SUI liability account # |

|

34. |

Emp OST-1 liability acct # |

|

38. |

Emp OST-2 liability acct # |

|

41. |

Empr OST liab acct # |

|

42. |

Empr OST expense acct # |

The affected City tax code account field is:

|

5. |

Tax liab acct # |

Maximum wages

There is frequently a ceiling on the dollar wages subject to a particular tax. In each such case, a field called xxxx max wages is provided so you can specify this ceiling (where xxxx is the name of the tax).

When no such ceiling applies, the maximum is infinite. To be correct arithmetically, a value such as 9999999.99 should be entered here.

To simplify matters PBS adopts the convention that a zero maximum is to be interpreted as infinity. Thus if no maximum applies, you need only press <Enter>. No maximum will display on the screen.

Select

Tax tables from the Master information menu.

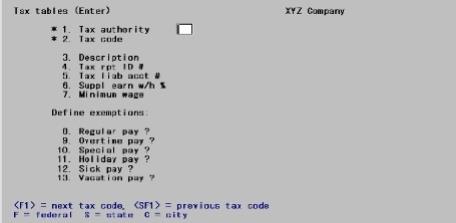

The following screen displays in character mode:

From this screen you can work with both new and existing tax codes. If a tax code has already been entered for the tax authority and code you specify, that tax code will appear and be available for changes or deletion.

|

Note |

Examples for most fields are provided. These examples may not accurately reflect the actual amounts and settings as required by the IRS, the SSA or your state. Please see the appropriate documentation from each taxing jurisdiction before you enter these fields. |

Enter the following information:

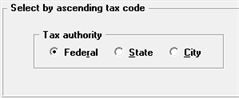

You must first enter the taxing authority. Using graphical you have the following choices.

The various tabs are enterable depending on the type of authority selected as indicated in this table:

| Tab | Federal | State | City |

|---|---|---|---|

|

General |

Yes |

Yes |

Yes |

|

Federal SS/Medc |

Yes |

No |

No |

|

Federal accounts |

Yes |

No |

No |

|

Federal w/h |

Yes |

No |

No |

|

State/City information |

No |

Yes |

Yes |

|

State SUI/OST |

No |

Yes |

No |

|

State/City w/h |

No |

Yes |

Yes |

Depending on which tax authority is selected (see Tax authority field below), either one federal record or potentially multiple city or state records will display in the list box. The records may be sorted by tax code, either ascending or descending.

You may click on a button or enter the keyboard equivalent for adding, editing, deleting or canceling a tax table entry:

| Button | Keyboard | Description |

|

New |

Alt+n |

To enter a new tax table |

|

Delete |

Alt+d |

To remove a tax table. You may also use the <F3> key |

|

Edit |

Alt+e |

To edit the tax table selected in the list box |

|

Save |

Alt+s |

To save a tax table or changes to an existing table |

|

Save/New |

Alt+w |

This button is not active on this screen |

|

Cancel |

Alt+c |

To cancel adding or editing a tax table |

|

Exit |

Alt+x |

To exit the screen. You may also use the <Esc> key |

Options

Using character, enter F for federal, S for state, or C for city to designate the tax authority for this code, or use one of the options:

|

F1> |

To display the next code |

|

SF1> |

To display the previous code |

|

Format |

Graphical: Radio buttons Character: One letter, either F, S, or C |

|

Example |

Select the Federal button or type F |

For state and city codes, you must also enter the Tax code field in addition to the tax authority.

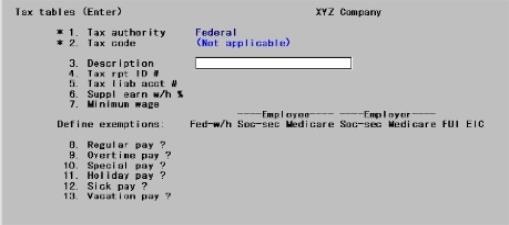

For the federal tax authority, the following tab displays:

Graphical

Character

Continue entering information as follows:

Tax code

You do not have to enter this field since there is only one federal tax code. State and city tax codes will be described later in this chapter.

Enter a description of the tax code. The first nine characters print on W-2 forms. For state or city, this name of the state or city is typically entered in this field.

|

Format |

25 characters |

|

Example |

Type Federal tax code |

Enter your federally assigned employer identification number.

Although 15 characters are allowed in this field, you should enter your taxpayer identification number correctly formatted, starting with the first character position of the field.

Your federal taxpayer identification number is in the format of an employer identification number (99-9999999) or in the format of a social security number (999-99-9999).

|

Format |

15 characters |

|

Example |

Type 95-1135917 |

Options

Enter the number of the G/L account to which withholding taxes payable are posted

|

<F5> |

For variable cost center. Refer to the Account Numbers section |

|

Format |

Your standard account number format, as defined in Company information |

|

Example |

Enter account 2100-000 |

You can specify that an employee is to receive supplemental earnings by entering a temporary earning code of type S in Time worked. Such earnings will be taxed at the flat percentage rate that you enter here.

Alternatively, you can have such earnings taxed at the regular rate by specifying a zero percent here. In this case supplemental earnings are added to regular earnings and then the sum is taxed at the rates contained in the federal tax rate table as described later in this chapter.

Enter the flat percentage rate at which supplemental earnings should be taxed.

|

Format |

99.99 |

|

Example |

Type 20 |

Enter the minimum wage here.

|

Format |

99.999 |

|

Example |

Type 7.25 |

Next, you specify which types of pay are exempt from the various federal taxes.

The pay types are regular, overtime, special, holiday, sick, and vacation. Salary is considered regular pay here.

Earnings codes are not included since you can specify, for each earnings code entered in Deductions/Earnings, whether it is exempt or not for each of the federal taxes shown below.

The federal taxes are:

| • | Fed-w/h (Federal withholding tax) |

| • | Employee Soc-sec |

| • | Employee Medicare |

These are taxes deducted out of an employee’s pay check.

| • | Employer Soc-sec |

| • | Employer Medicare |

| • | FUI (Federal unemployment insurance, also known as FUTA, Federal Unemployment Tax Act) |

These are taxes paid by an employer. An employee is not responsible for these taxes.

Use the following table to define exemptions for the federal tax authority:

|

|

Employee |

Employer |

||||

|

|

Federal w/h |

Social Security |

Medicare |

Social Security |

Medicare |

FUI |

|

Regular pay |

X |

X |

X |

X |

X |

X |

|

Overtime pay |

X |

X |

X |

X |

X |

X |

|

Special pay |

X |

X |

X |

X |

X |

X |

|

Holiday pay |

X |

X |

X |

X |

X |

X |

|

Sick pay |

X |

X |

X |

X |

X |

X |

|

Vacation pay |

X |

X |

X |

X |

X |

X |

In place of each X, check the box or leave it unchecked (enter a Y or an N for character) to specify whether the pay type is exempt from inclusion in the wage base on which that deduction type is calculated. Check the box if the pay type is exempt from that particular tax deduction or contribution. The default is always N.

For example, the first check box as if in response to the question: Is regular pay exempt from federal withholding?. After you enter the first field, the cursor moves one column right, and you enter each field in turn. The cursor then drops to the first column of the next row and continues to move to the right after each answer. Fill the entire table this way.

In character change mode, you can change any one row independently of the others, but you must enter each column of the row. When adding a record, the cursor moves successively through all the rows and columns.

The row descriptions for state and city are the same as for federal, but the column headings vary for each tax authority. The federal column headings are shown above. State and city column headings will be described in a later section of this chapter.

|

Format |

Graphical: Check box where checked is exempt and unchecked is taxed Character: One character for each exemption, either Y or N. In add mode, you can press <Enter> for N. |

|

Example |

Enter N for each field. |

Character Mode

Field number to change ?

Options

Make any desired changes. In change mode, you can also use one of the options:

|

<F1> |

To display the next code |

|

<SF1> |

To display the previous code |

|

<F3> |

To delete this tax code. Do this only when the code is no longer assigned to any employee |

Press <Enter> to view the second tab:

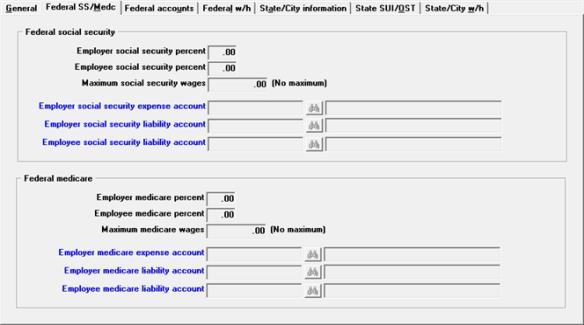

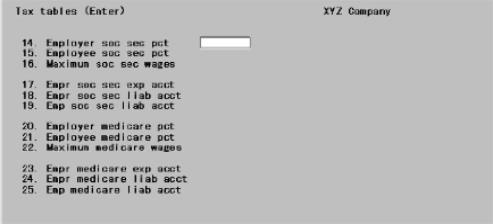

Graphical

Character

|

Note |

Examples for this screen may relate to past tax years. For the correct values for the current year, consult with your accountant. Refer also to IRS Circular E, which is also known as publication 15. |

Enter the following information:

Employer social security percent

Enter the employer’s share (percent) of social security tax.

|

Format |

99.99 |

|

Example |

Type 6.2 |

Employee social security percent

Enter the employee’s share (percent) of social security tax.

|

Format |

99.99 |

|

Example |

Type 4.2 |

Options

Enter the current maximum amount of wages subject to Social Security.

|

<Enter> |

For no maximum |

|

Format |

99999.99 |

|

Example |

Type 106800 |

|

Note |

WARNING: The value you enter in field 16 is used as a maximum cutoff amount when calculating social security and for creating Printed W-2 forms and Electronic W-2's. If you process W-2's after your first check run for the next year, this value must represent the correct value for the year that you are processing W-2 Forms for. You may not have any employees that reach the maximum before you process your W-2’s, but if necessary, change to the new maximum before your check run. Then change it back to the previous year maximum just before the processing of W-2’s. Change it back to the current year amount after processing W-2’s. |

Employer social security expense account

Options

Enter the number of the expense account that accumulates employer social security tax expenses.

|

<F5> |

For variable cost center. Refer to the Account Numbers section |

|

Format |

Your standard account number format, as defined in Company information |

|

Example |

Type 6100 and press <F5> |

Employer social security liability account

Options

Enter the number of the account that accumulates the employer portion of social security tax liability.

|

<F5> |

For variable cost center. Refer to the Account Numbers section |

|

Format |

Your standard account number format, as defined in Company information |

|

Example |

Type 2120 and press <F5> |

Employee social security liability account

Options

Enter the number of the account that accumulates the amount of the social security tax withheld from employee pay.

|

<F5> |

For variable cost center. Refer to the Account Numbers section |

|

Format |

Your standard account number format, as defined in Company information |

|

Example |

Enter account 2120-000 |

Enter the employer’s share (percent) of medicare tax.

|

Format |

99.99 |

|

Example |

Type 1.45 |

|

Note |

In PBS 12.02.01 PSI has implemented the Additional Medicare Tax which goes into effect January 1, 2013. The Additional Medicare Tax applies to individuals’ wages, other compensation, and self-employment income over certain thresholds; employers are responsible for withholding the tax on wages and other compensation in certain circumstances. You may read questions and answers about the regulations here: http://www.irs.gov/Businesses/SmallBusinessesSelf-Employed/Questions-and-Answers-for-the-Additional-Medicare-Tax The Additional Medicare Tax goes into effect on January 1, 2013. Payroll runs using this check date so after January 1, 2013 will be affected by the programming changes when the employee qualifies. There are no Payroll settings to change for calculating the Additional Medicare Tax. |

Enter the employee’s share (percent) of medicare tax.

|

Format |

99.99 |

|

Example |

Type 1.45 |

Options

Enter the maximum amount of wages subject to medicare taxes.

|

<Enter> |

For no maximum |

|

Format |

99999.99 |

|

Example |

Press <Enter> |

Employer medicare expense account

Options

Enter the number of the expense account that accumulates employer medicare tax expenses.

|

<F5> |

For variable cost center. Refer to the Account Numbers section |

|

Format |

Your standard account number format, as defined in Company information |

|

Example |

Type 6100 and press <Enter> |

Employer medicare liability account

Options

Enter the number of the account that accumulates the employer portion of medicare tax liability.

|

<F5> |

For variable cost center. Refer to the Account Numbers section. |

|

Format |

Your standard account number format, as defined in Company information |

|

Example |

Enter account 2121-000 |

Employee medicare liability account

Options

Enter the number of the account that accumulates the amount of the medicare tax withheld from employee pay.

|

<F5> |

For variable cost center. Refer to the Account Numbers section |

|

Format |

Your standard account number format, as defined in Company information |

|

Example |

Enter account 2121-000 |

Make any desired changes. Press <Enter> to view the third tab.

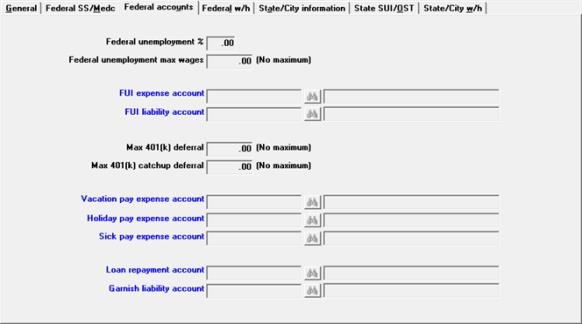

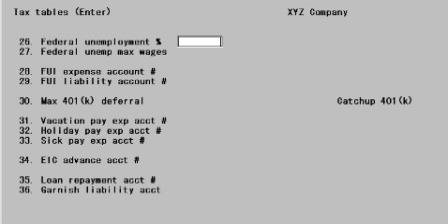

Graphical

Character

In PBS Payroll this employer tax is known as Federal Unemployment Insurance and is abbreviated to FUI. You may know it as FUTA, which is an abbreviation for Federal Unemployment Tax Act.

Enter the employer's share (percent) of social security tax.

|

Format |

99.99 |

|

Example |

Type 6.0 |

Federal unemployment max wages

Options

Enter the maximum annual wage on which unemployment tax can be assessed.

|

<Enter> |

For no maximum |

|

Format |

99999.99 |

|

Example |

Type 7000 |

Options

Enter the number of the expense account that accumulates federal unemployment insurance contributions.

|

<F5> |

For variable cost center. Refer to the Account Numbers section |

|

Format |

Your standard account number format, as defined in Company information |

|

Example |

Type 6110 and press <F5> |

Options

Enter the number of the account that accumulates the amount of the FUI contribution calculated by the software.

|

<F5> |

For variable cost center. Refer to the Account Numbers section |

|

Format |

Your standard account number format, as defined in Company information |

|

Example |

Enter account 2130-000 |

A 401(k) plan allows an employee to defer income by having the employer make contributions on behalf of the employee. These contributions are specified as type K codes in Deductions/Earnings. See 401(k) Elective deferral Code in the Deductions/Earnings chapter. Such contributions are called elective deferrals. This field applies to regular and Roth 401(k) types. Also see 401(k) Plans

Once you have defined the type K codes, you then enter the actual Regular and Roth 401(k) deduction amounts in each employee’s record as a permanent deduction, but only if an employee has elected to take these deferrals.

One of the limitations of a 401(k) deferred compensation plan is that there is an annual limitation on elective deferrals. This maximum is the lesser of any plan-specified maximum or the Federal 401(k) for the current year.

Enter the maximum allowed by your plan or the Federal 401(k) maximum for the current year or press <Enter> to specify no maximum.

|

Format |

99999.99 |

|

Example |

Type 17000 |

After you enter the maximum 401(k) deferral amount the software will prompt you to enter a maximum amount for the 401(k) Catchup provision.

If applicable, enter the Catchup maximum deferral amount or press <Enter> to specify no maximum. This amount is the additional amount allowed for 401(k) catchup.

|

Format |

99999.99 |

|

Example |

Type 5500 |

If you have an employee that uses the Catchup feature, you will need to setup the employee to use the new Catchup 'C' code in their 401(k). For more information, please refer to setup details about Employee 401(k) in the Employees chapter.

Options

Enter the main account number of the expense account to use for vacation pay.

|

<F5> |

For variable cost center |

|

<SF5> |

To make the entire account number vary by employee |

|

Format |

Your standard account number format, as defined in Company information |

|

Example |

Type 6020 and press <F5> |

Options

Enter the number of the expense account for holiday pay.

|

<F5> |

For variable cost center |

|

<SF5> |

To make the entire account number vary by employee |

|

Format |

Your standard account number format, as defined in Company information |

|

Example |

Type 6030 andd press <F5> |

Options

Enter the number of the expense account for sick pay.

|

<F5> |

For variable cost center |

|

<SF5> |

To make the entire account number vary by employee |

For these options, refer to the Account Numbers section.

|

Format |

Your standard account number format, as defined in Company information |

|

Example |

Press <SF5> |

Options

Enter the number of the account that accumulates the value of the loan repayments deducted from employee pay.

|

<F5> |

For variable cost center. Refer to the Account Numbers section. |

|

Format |

Your standard account number format, as defined in Company information |

|

Example |

Enter account 1110-000 |

Options

Enter the number of the account that accumulates the value of garnishment deductions.

|

<F5> |

For variable cost center. Refer to the Account Numbers section. |

|

Format |

Your standard account number format, as defined in Company information |

|

Example |

Enter account 2030-000 |

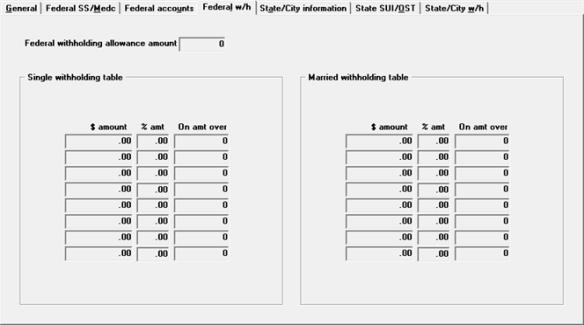

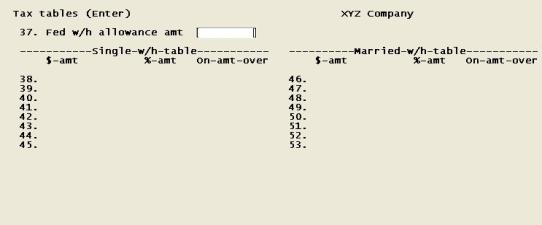

Make any desired changes. Click on the next tab or using character press <Enter> from the last field to view the fourth screen:

Graphical Mode

Character Mode

Federal withholding allowance amount

The withholding allowance amount is the amount by which gross pay is reduced for each exemption (e.g. for spouse and dependent children) the employee claims. Enter the dollar amount of the annual federal withholding allowance.

|

Format |

99999.99 |

|

Example |

Type 2050 |

Married withholding table

The rest of the fields on this screen are filled out using information contained in the Department of the Treasury, Internal Revenue Service “Circular E, Employer’s Tax Guide.” This is also known as publication 15. This information may be available at this address: http://www.irs.gov/publications/p15/index.html. The IRS may change this information at any time. Please revisit the IRS web site often for any updates.

Use the values from the “ANNUAL Payroll Period” table for the percentage method of withholding.

Each of the tables is structured to allow entering a tax amount in dollars ($-amount) plus a percent of income (%-amt) where the income exceeds a minimum level (On-amt-over).

Make any changes and select Save (press <Enter> in character) to complete entry of federal tax code information for Payroll.

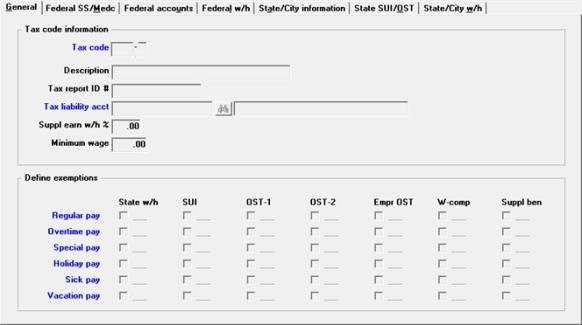

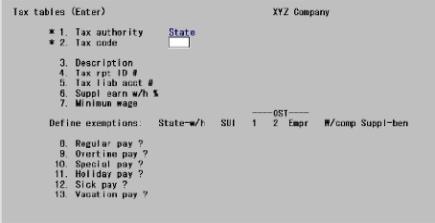

Explanations of fields which are the same for state tax codes as for federal are not repeated in this section.

Graphical Mode

Character Mode

Tax authority

This identifies whether the taxing authority is the federal government, the state, or a city.

|

Format |

One letter, either F, S, or C |

|

Example |

Type S |

A two-character code should uniquely identify a city or state: NY can be used for both New York State and New York City. However, NY should not represent any other city or any other state. This is particularly important if city taxes are to be paid to state authorities.

The program does not validate that the first two characters correspond to a valid U.S. postal abbreviation, but you should ensure that they do. Otherwise you will not be able to report information for that state on the year-end W-2 statements.

For state and city codes, the code is in two parts. First, enter the state or city and then enter the table code.

|

Format |

Two characters (for state), one character (for the table) |

|

Example |

Type CA and type S |

Do you wish to copy this code from another state code ?

If this is a new entry, you are asked this question. Answer Y to use an existing table as a model for this new table.

This feature can be very useful if you are entering several codes for the same state or city, since the first and second screens are usually the same (only the third screen is different, usually married instead of single).

|

Format |

One letter, either Y or N |

|

Example |

Type N |

Enter the code to be copied from

If you answer Y, enter the table you will use as a model. This must already be on file.

|

Format |

Two characters (for state or city), one character (for the table) |

|

Example |

Does not appear because you are not copying in this example) |

Description

Tax report ID #

Tax liability acct

Suppl earn w/h %

|

Format |

Refer to the information previously provided about these fields. |

The state minimum wage is used for calculating the state tip credit for an employee.

There are also two special state minimum wages, 0 and 99.99. The 0 signifies that the state tip credit will be 0. The 99.99 signifies that the state tip credit will be the sum of all reported tips for the employee.

|

Format |

99.999 |

|

Example |

Type 4.25 |

Specify which types of pay are exempt from the various state taxes. Exemptions are entered for state tax codes in the same way as already described for the federal tax. See Define exemptions for federal. The rows are the same but the columns are different.

Define state exemptions:

|

|

Exemptions |

||||||

|

|

State w/h |

SUI |

OST 1 |

OST 2 |

Empr OST |

Wkrs’ Comp |

Suppl Ben |

|

Regular pay ? |

X |

X |

X |

X |

X |

X |

X |

|

Overtime pay ? |

X |

X |

X |

X |

X |

X |

X |

|

Special pay ? |

X |

X |

X |

X |

X |

X |

X |

|

Holiday pay ? |

X |

X |

X |

X |

X |

X |

X |

|

Sick pay ? |

X |

X |

X |

X |

X |

X |

X |

|

Vacation pay ? |

X |

X |

X |

X |

X |

X |

X |

State-w/h, OST-1, OST-2

State withholding tax (State-w/h), other state tax #1 (OST-1), and other state tax #2 (OST-2) are all employee taxes and are deducted from employees’ paychecks.

When a type of pay is exempt from one of these taxes, this means that the gross wages on which the amount of the tax is calculated does not include the pay types that are exempt.

SUI, Empr OST, W-comp, Suppl ben

State unemployment insurance (SUI), employer other state tax (Empr OST), workers’ compensation (W-comp), and supplemental benefits (Suppl ben) are all employer contributions within this section, rather than being employee deductions.

When a type of pay is exempt from one of these contributions, this means that the gross wages on which the amount of the contribution is calculated does not include the pay types that are exempt.

|

Format |

One character for each exemption, either Y or N. In add mode, you can press <Enter> for N. |

|

Example |

Enter N for each field. |

When finished, click on the State/City information tab.

Character Mode

Field number to change ?

Options

Make any desired changes. In change mode, you can also use one of the options:

|

<F1> |

To display the next code |

|

<SF1> |

To display the previous code |

|

<F3> |

To delete this tax code. Do this only when the code is no longer assigned to any employee. |

Press <Enter> to view the second tab:

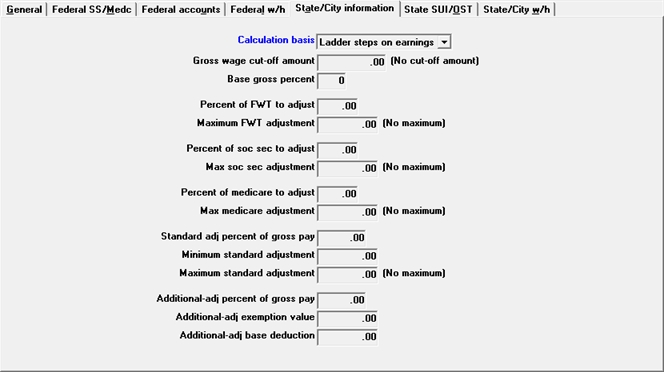

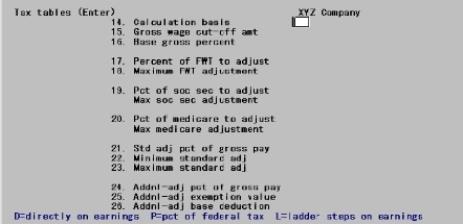

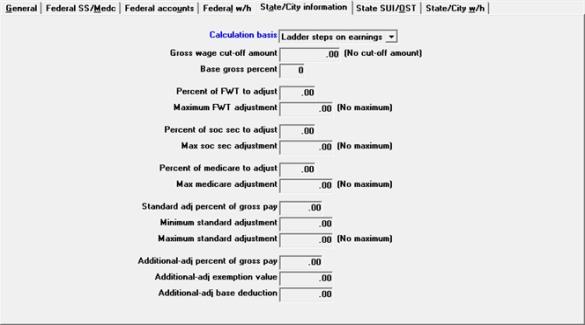

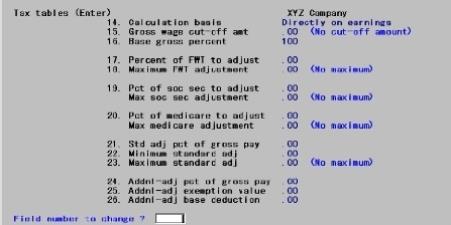

Graphical Mode

Character Mode

Options

When you enter the state withholding tax table, the tax to withhold is based on either earnings or federal withholding tax, depending on your answer here:

| Character | Graphical | Description |

|

L |

Ladder steps on earnings |

For a state tax is calculated directly on the basis of earnings in ladder steps. (The state of Iowa uses this method.) |

|

D |

Directly on earnings |

For a state tax is calculated based directly on earnings |

|

P |

Pct of federal tax |

For a state tax calculated as a percentage of the employee’s federal withholding tax amount |

|

Format |

Graphical: Drop down list Character: One letter from the list above |

|

Example |

Type D, since the tax in California is assessed directly upon earnings |

|

Note |

Refer to the State Withholding Tax Calculations appendix for SWT calculations. |

Some states impose income tax only on a portion of an employee’s income up to a cut-off amount. You enter the annual cut-off amount here. If your state does not specify a cut-off, press <Enter> to skip this field, in which case no cut-off is applied to the employee’s income.

The result from this cutoff calculation is used as input to the calculation specified by the next field.

This field is applicable only if the state tax calculation is based on earnings.

|

Note |

Only the portion of income in excess of the cut-off is taxed at the Added SWT percentage rate in the Employee record when that employee field is specified as a percentage. Added SWT in Employees can also be specified as an amount or as a surcharge percent. In these cases the excess portion of income above the cut-off amount is not used for computing Added SWT. Refer to the State Withholding Tax Calculations appendix for additional information. |

Enter the gross wage cut-off amount or just press <Enter> for no cut-off amount.

|

Format |

99999999.99 |

|

Example |

Press <Enter> |

This is the percentage of pay subject to state withholding tax. First, the cut-off amount calculation is applied as described above for the Gross wage cut-off amount field. Then the result of that calculation is used with the percentage entered here to get the base amount for calculation of state withholding tax. If this field is zero, no tax is computed.

If your state does not specify use of a percent of pay, set this field to 100 to use the full amount of the result from the Gross wage cut-off amount field calculation for computing state withholding tax.

This field is applicable only if the state tax calculation is based on earnings.

|

Note |

Further adjustments to the taxable pay amount may occur depending upon how you enter the following fields. Refer to the State Withholding Tax Calculations appendix for additional information about SWT calculations. |

Options

Enter the percent of pay to be used for SWT calculation or use the option:

|

<F2> |

To use 100 percent |

|

Format |

999 |

|

Example |

Press <F2> for 100% |

This field and the next field are used for computing an adjustment to gross pay for federal income tax withheld.

Enter the percentage of FWT by which to adjust the gross pay or press <Enter> if there is no adjustment.

This field is applicable only if the state tax calculation is based on earnings.

|

Format |

999.99 |

|

Example |

Press <Enter> |

This field allows you to specify a maximum amount by which gross pay can be adjusted for FWT.

If the FWT adjustment is greater than the maximum entered here, this maximum amount is used as the FWT adjustment.

Options

This field is applicable only if the state tax calculation is based on earnings.

|

<Enter> |

For no maximum |

|

Format |

999999.99 |

|

Example |

Press <Enter> |

This field is similar to the Percent of FWT to adjust field above, except it allows you to adjust for social security tax withheld instead of FWT.

This field is applicable only if the state tax calculation is based on earnings.

|

Format |

999.99 |

|

Example |

Press <Enter> |

This field is similar to the Maximum FWT adjustment field above, except it allows you to specify the maximum adjustment for social security instead of the maximum adjustment for FWT.

Options

This field is applicable only if the state tax calculation is based on earnings.

|

<Enter> |

For no maximum |

|

Format |

999999.99 |

|

Example |

Press <Enter> |

This field is similar to the Percent of FWT to adjust field above, except it allows you to adjust for medicare tax withheld instead of FWT.

This field is applicable only if the state tax calculation is based on earnings.

|

Format |

999.99 |

|

Example |

Press <Enter> |

This field is similar to the Maximum FWT adjustment field above, except it allows you to specify the maximum adjustment for medicare instead of the maximum adjustment for FWT.

Options

This field is applicable only if the state tax calculation is based on earnings.

|

<Enter> |

For no maximum |

|

Format |

999999.99 |

|

Example |

Press <Enter> |

Standard adj percent of gross pay

Some states allow you to adjust an employee’s income down by a standard percentage before calculating SWT. This field allows you to specify that percentage. In addition to the standard percentage some states specify that this adjustment be no less than a minimum amount and/or no greater than a maximum amount. The next two fields allow you to specify these minimum and maximum amounts for this adjustment.

This field is applicable only if the state tax calculation is based on earnings.

Options

Enter the standard adjustment percentage or just press

|

<Enter> |

For no adjustment of gross pay |

|

Format |

999.999- |

|

Example |

Press <Enter> |

As described above for the Standard adj percent of gross pay field, you specify the minimum standard adjustment amount by entering that amount here.

This field is applicable only if the state tax calculation is based on earnings.

Enter the minimum standard adjustment or just press <Enter> for no minimum adjustment.

|

Format |

999999.99 |

|

Example |

Press <Enter> |

As described above, for the Standard adj percent of gross pay field, specify the maximum standard adjustment amount by entering that amount here.

Options

This field is applicable only if the state tax calculation is based on earnings.

|

<Enter> |

For no maximum |

|

Format |

999999.99 |

|

Example |

Press <Enter> |

Additional-adj pct of gross pay

This field and the next two fields are primarily for use by Oklahoma employers. The State of Oklahoma allows a second adjustment to an employee’s gross income before computing SWT. The adjustment percentage entered here is applied to an employee’s gross income after subtracting two amounts:

The first amount subtracted is an amount calculated by multiplying the exemption value (Additional-adj exemption value field below) by the number of SWT exemptions.

The second amount subtracted is the base deduction entered at the Additional-adj base deduction field.

The percentage entered for this field is applied to an employee’s gross income after subtracting the two amounts described above. When the result of the subtractions is zero or negative, this additional adjustment is set to zero.

Enter the additional adjustment percentage or just press <Enter> for no adjustment percentage.

|

Format |

999.999 |

|

Example |

Press <Enter> |

Additional-adj exemption value

This field is used in conjunction with the Additional-adj pct of gross pay field above. Refer to the description for that field for an explanation of how this field is used.

|

Note |

If Additional-adj pct of gross pay field is zero, any value entered here is ignored when SWT is calculated. |

Enter the additional adjustment exemption value or just press <Enter> for no exemption value.

|

Format |

999999.99 |

|

Example |

Press <Enter> |

This field is used in conjunction with the Additional-adj pct of gross pay field above. Refer to the description for that field for an explanation of how this field is used.

|

Note |

If the Additional-adj pct of gross pay field is zero, any value entered here is ignored when SWT is calculated |

Enter the base deduction or just press <Enter> for no base deduction.

|

Format |

999999.99 |

|

Example |

Press <Enter> |

Make any desired changes. In character there are no option keys apply at this point.

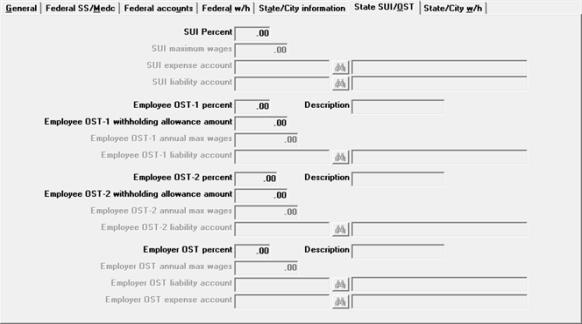

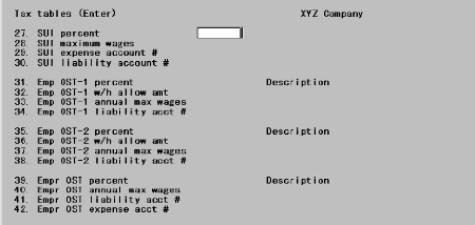

Click on the State SUI/OST tab or press <Enter> from the last field to view the tab:

Graphical Mode

Character Mode

This field and the next three relate to State Unemployment Insurance. In general, each state has an unemployment insurance program which employers must contribute to. SUI is usually calculated as a percent of employee income, subject to a maximum above which income is not taxed.

A few states may also have more than one unemployment insurance pool and require that the amounts for each pool be calculated separately. Fields #39 through 42 are provided for this situation.

The rate at which SUI is calculated and the maximum wage amount are set by the state government. Generally, there is a rate for new employers. Once an employer has been in business for a length of time specified by the state, this rate is changed to an experience rate which is generally lower than the new employee rate. Consult with your accountant or state government for the right rate to use.

In some states an employee may also be required to contribute to SUI, in which case use Fields #31 through 34 and 35 through 38 as needed.

Enter the appropriate rate at which you are being charged for state unemployment insurance.

|

Format |

9.9999 |

|

Example |

Type 3.4 |

You use this field to specify the maximum annual wage subject to SUI. This maximum is for each employee.

For example, if an employee earns $26,000 per year and this field is set to $7,000, only the first $7,000 of an employee’s income is taxed. At a rate of 3.4%, the maximum annual tax is $238. If the employee is paid weekly, the employer is charged at the rate of 3.4% on $500, (i.e., $17.00 weekly) until the employee has earned $7,000 for the year.

|

Note |

For employees taxable by more than one state, if the SUI reporting method field of Control information is set to Work state then each state’s SUI maximum is applied separately to the employee’s wages reported to that state. |

Options

Enter the maximum dollar amount on which SUI is to be calculated for each employee.

|

<Enter> |

For no maximum |

|

Format |

99999.99 |

|

Example |

Type 7000 |

Options

This account is used to accumulate the expense of SUI tax.

|

<F5> |

For variable cost center. |

Format Your standard account number format, as defined in Company information

|

Example |

Type 6120 and press <F5> |

This account is used to accumulate the amount of SUI tax you owe the state government.

Periodically you must pay the amount accumulated to the state government. Consult with your accountant or your state government for how often this must be done. Use a manual check drawn on a cash account defined in your PBS system to make the payment.

Options

If you are not using Passport Business Solutions (PBS) Accounts Payable but you are using PBS General Ledger, enter this check as a general journal entry showing a credit to the appropriate cash account and a debit to this liability account

|

<F5> |

For variable cost center |

|

Format |

Your standard account number format, as defined in Company information |

|

Example |

Enter account 2150-000 |

This field and the following three fields relate to the first employee other state tax. These fields are provided to handle various tax situations other than SWT and SUI.

One example of this is California State Disability Insurance. Another example is the need for computing tax for another state in the case where an employee lives in one state but works in another state.

This tax is calculated by applying the percentage entered for this field to an employee’s income up to the maximum specified in Employee OST-1 annual max wages field.

This calculation is done after deducting any allowance amount as specified by Employee OST-1 withholding allowance amount field.

If you do not need to calculate other state tax for your employees, press <Enter> to set this percent to zero.

Enter the appropriate percent for your situation.

|

Format |

99.9999 |

|

Example |

Type .9 |

|

Note |

You can report this tax on an employee’s W-2 form in box 18. Refer to the Year-End Payroll chapter. After entry of a non-zero percent, you can enter a 15-character description for this other state tax, which is used to identify the tax amount when reporting it in box 18 on the employee’s W-2 form. |

If you have entered a non-zero amount for this other state tax, enter a description to correspond:

|

Format |

15 characters |

|

Example |

Type CASDI |

Employee OST-1 withholding allowance amount

This field allows you to specify the value of one withholding allowance for OST-1. This value is multiplied by the number of withholding exemptions for OST-1 and the result is deducted from the employee’s wages.

Enter the value of one withholding exemption or just press <Enter> for zero

|

Format |

999999.99 |

|

Example |

Press <Enter> |

Employee OST-1 annual max wages

or

Employee OST-1 weekly max wages

This field specifies the taxable wage base for OST-1 after any withholding allowance amount has been deducted.

Options

Initially this allows entry of an annual maximum, but the option lets you change to a weekly maximum

|

Note |

When this field is a weekly maximum tax, its amount is adjusted to the employee’s pay period at the time that the tax is calculated. For example, if the weekly maximum tax is $25 but an employee’s pay period is bi-weekly, the actual maximum tax used on each of this employee’s bi-weekly paychecks is $50. For employees taxable by more than one state, the work state’s OST-1 maximum is applied to the employee’s wages reported to all states. |

|

<F2> |

To toggle between entering annual and weekly amounts. |

|

<Enter> |

For no maximum |

|

Format |

99999999.99 |

|

Example |

Type 25149 |

Employee OST-1 liability account

Options

This account is used to accumulate the amount of OST-1 tax you owe the state government.

|

<F5> |

For variable cost center |

|

Format |

Your standard account number format, as defined in Company information |

|

Example |

Enter account 2160-000 |

This field and the following three fields relate to the second employee other state tax. These fields are provided to handle various tax situations other than SWT, SUI, and OST-1.

Entries for this field and the next three fields are handled in the same way as for the OST-1 fields above.

Like OST-1, when you enter a percent, you can also enter a 15-character description for this OST-2 tax.

Enter the appropriate percent for your situation.

|

Format |

99.9999 |

|

Example |

Press <Enter> |

If you have entered a non-zero amount for this other state tax, enter a description to correspond:

|

Format |

15 characters |

|

Example |

(This field is skipped because you entered zero for percent) |

Employee OST-2 withholding allowance amount

Enter the value of one withholding exemption for OST-2 or press <Enter> for zero.

|

Format |

999999.99 |

|

Example |

(This field is skipped because you entered zero for the Employee OST-2 percent field.) |

Employee OST-2 annual max wages

or

Employee OST-2 weekly max wages

Enter the annual wage maximum If no maximum applies, press <Enter> to set this field to zero.

|

Note |

For employees taxable by more than one state, the work state’s OST-2 maximum is applied to the employee’s wages reported to all states. |

Options

Initially this allows entry of an annual maximum, but the option lets you change to a weekly maximum.

|

<F2> |

To toggle between entering annual and weekly amounts |

|

<Enter> |

For no maximum |

|

Format |

99999999.99 |

|

Example |

(This field is skipped because you entered zero for the Employee OST-2 percent field.) |

Employee OST-2 liability account

Options

Enter the appropriate account number.

|

<F5> |

For variable cost center |

|

Format |

Your standard account number format, as defined in Company information |

|

Example |

(This field is skipped because you entered zero for the Employee OST-2 percent field.) |

The previous eight fields allowed two additional state taxes to be defined, OST-1 & OST-2. These taxes are deducted out of an employee’s pay check and are referred to as employee paid.

In addition, this field and the next three fields allow you to define an additional state tax which is employer paid.

Like OST-1 and OST-2, when you enter a percent, you can also enter a 15-character description for this Empr-OST tax.

Enter the appropriate percent for your situation followed by a description.

|

Format |

99.9999 |

|

Example |

Press <Enter> |

If you have entered a non-zero amount for this other state tax, enter a description to correspond:

|

Format |

15 characters |

|

Example |

(This field is skipped because you entered zero for percent) |

Employer OST annual max wages or

Employer OST weekly max wages

Entry for this field is handled in the same way as for the annual maximum fields for OST-1 & OST-2 above.

Enter the annual wage maximum. If no maximum applies, press <Enter> to set this field to zero.

Options

Initially this allows entry of an annual maximum, but the option lets you change to a weekly maximum.

|

<F2> |

To toggle between entering annual and weekly amounts. |

|

<Enter> |

For no maximum |

|

Format |

99999999.99 |

|

Example |

(This field is skipped because you entered zero for the Employer OST percent field.) |

|

Note |

For employers taxable by more than one state, the work state’s employer OST maximum is applied to the wages reported to all states. |

Employer OST liability account

Options

Enter the appropriate account number.

|

<F5> |

For variable cost center |

|

Format |

Your standard account number format, as defined in Company information |

|

Example |

(This field is skipped because you entered zero for the Employer OST percent field.) |

Options

Since this tax is employer-paid, you must enter an expense account in addition to the liability account.

|

<F5> |

For variable cost center |

|

Format |

Your standard account number format, as defined in Company information |

|

Example |

(This field is skipped because you entered zero for the Employer OST percent field.) |

Make any desired changes. Press <Enter> to view the fourth and final tab for state tax codes:

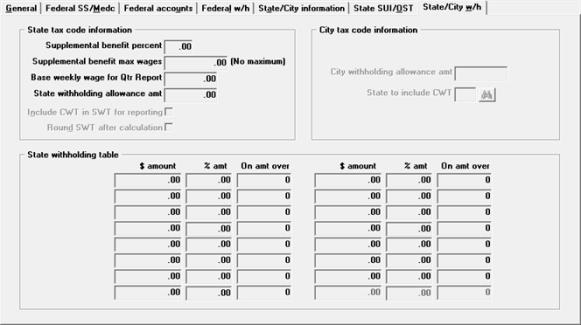

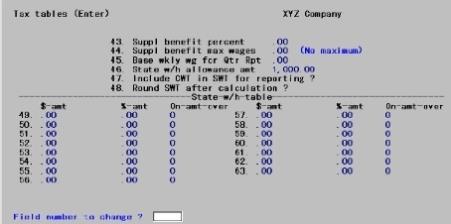

Graphical Mode

Character Mode

If your state requires an employer contribution for supplemental benefits, enter the percent of employee pay that must be contributed by the employer. This is an employer expense, not an employee withholding.

The Payroll package reports the supplemental benefit amount that the employer is required to contribute, but it will not create the G/L distributions for expense and liability. These G/L entries must be made manually, based upon the reported supplemental benefit amount.

|

Format |

99.99 |

|

Example |

Press <Enter> since supplemental benefits are not applicable to California. |

Supplemental benefit max wages

Options

Enter the maximum dollar amount of the employee’s annual wage on which this employer contribution is calculated.

|

Note |

For employees taxable by more than one state, the work state’s supplemental benefits maximum is applied to the employee’s wages reported to all states. |

|

<Enter> |

For no maximum |

|

Format |

99999999.99 |

|

Example |

Press <Enter> |

Base weekly wage for Qtr Report

If your state requires a base weekly wage for the Quarterly Payroll Report, enter the amount here. Otherwise, press <Enter> to skip this field.

|

Format |

99999.99 |

|

Example |

Press <Enter> |

State withholding allowance amt

Enter the value of a single withholding exemption. This amount is applicable only if the state tax is calculated based on earnings.

In the Employees selection, you can specify both an exemption amount and a number of exemptions.

The total withholding exemption for an employee is: Number of exemptions times the withholding allowance exemption amount.This computation method applies to:

| • | Federal withholding tax (FWT) |

| • | State withholding tax (SWT) |

| • | Other state tax #1 (OST-1) |

| • | Other state tax #2 (OST-2) |

| • | City withholding tax (CWT) |

Note that, for employer OST (Empr-OST), there is only an exemption amount, which you define in Employees.

|

Format |

99999.99 |

|

Example |

Type 1000 |

Include CWT in SWT for reporting

Setting this flag to Y will allow you to connect specific cities to a state when city tax tables are entered. The year-to-date CWT for these cities will be added to the year-to-date SWT for reporting purposes.

If CWT is to be included in SWT, all the tax code records for a particular state (for example, California single, California married, and California head of household) should have this flag set the same: Y. Not doing so may produce unexpected amounts. In the City Tax Code section, for the State to include CWT field, be sure to enter the two character representation for the state — this will link the fields.

New York State currently requires that taxes withheld for New York City and Yonkers be included in the state’s Total tax withheld field on annual, quarter-to-date forms or electronic reports.

|

Format |

Graphical: Check box where checked is yes and unchecked is no Character: One letter, either Y or N. There is no default. |

|

Example |

Type Y |

Currently, Missouri requires dollar rounding the SWT amount withheld from employees. It this tax table is for Missouri residents (or residents of another state that requires rounding), answer Y.

|

Format |

One letter, either Y or N. The default is N. |

|

Example |

Press <Enter> for the default. |

On this screen, enter the annual state withholding table from your state’s Tax Guide for Employers.

The requirements for this screen are the same as those for the Federal withholding tables discussed earlier in the documentation. See Tax Tables

If the table you enter does not require all 15 fields, press <Enter> for each unused field to advance to the bottom of the table.

|

Format |

99999999.99- (for dollar amount) 99.99- (for percent) 99999999- (for “on amount over”) |

Make any desired changes. In graphical select Save to write the record. Select Cancel to not retain the new record or changes to the record.

Using character, no option keys apply at this point. Press <Enter> from Field number to change ? to conclude processing this tax code. The screen clears for the next tax code.

|

Note |

If the state calculation basis had been P (percent of federal withholding), you would have entered the percent to be applied against the federal withholding amount, rather than against the income amount. |

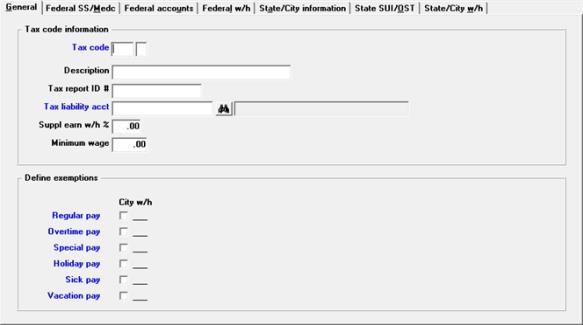

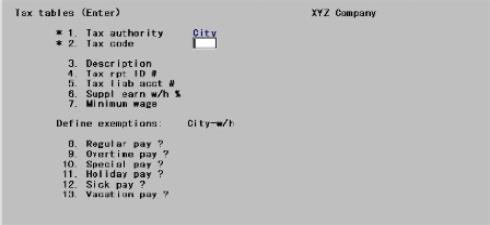

The third type of tax code is the city code for city withholding tax. The information requirements for this code are similar to those for a state code, although there are fewer fields.

These codes, although here called city codes, would also be used for any municipal taxing authority such a county, borough, etc.

For a city tax code, there are only three entry tabs, whereas for a state tax code there are four tabs. The second tab for a city tax code is identical to the second tab for a state tax code.

Tax authority

See Tax authority

The first tab for this code displays as follows:

Graphical Mode

Character Mode

Fields which are the same for city tax codes as for state are not explained again in this section.

|

Format |

Two characters (for city), one character (for the table) |

|

Example |

Type DT and type 1 |

Do you wish to copy this code from another city code ?

City codes can be copied as state codes can.

Description

Tax report ID #

Tax liability acct

Suppl earn w/h %

|

Format |

Refer to previous sections for descriptions of these fields. |

Refer to previous sections for descriptions of this field.

|

Format |

99.999 |

|

Example |

Press <Enter> |

Specify which types of pay is exempt from city tax. Exemptions are entered for city tax codes in the same way as already described for the federal tax. The rows are the same but there is only one column.

The table for city tax is as follows:

Define exemptions:

|

|

City-w/h |

|

Regular pay |

X |

|

Overtime pay |

X |

|

Special pay ? |

X |

|

Holiday pay ? |

X |

|

Sick pay ? |

X |

|

Vacation pay ? |

X |

|

Format |

Graphical: Check boxes where checked indicate the tax is exempt and unchecked it will be taxed. The default is unchecked Character: One character for each exemption, either Y or N. In add mode, you can press <Enter> for N |

|

Example |

Enter N for each field |

Character Mode

Field number to change ?

Options

Make any desired changes. In change mode, you can also use one of the options:

|

<F1> |

To display the next code |

|

<SF1> |

To display the previous code |

|

<F3> |

To delete this tax code. Do this only when the code is no longer assigned to any employee. |

Click on State/City information or press <Enter> from the last field to view the second tab:

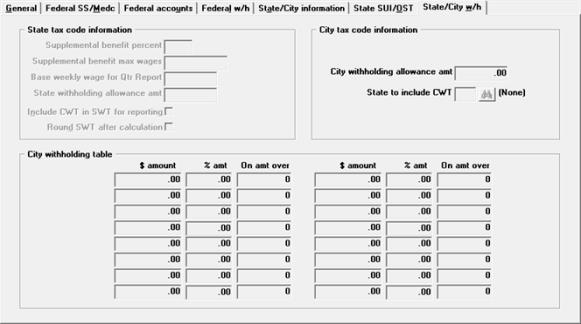

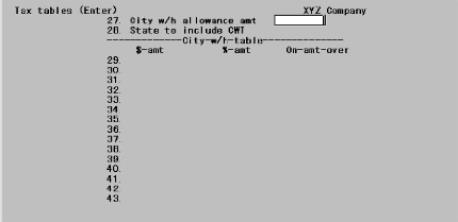

Graphical Mode

Character Mode

Calculation basis through Additional-adj base deduction

City withholding tax for this tab is calculated basically the same as state withholding tax.

|

Format |

The fields are identical to those for Fields #14-26 of state tax codes. Those descriptions will not be repeated here. |

|

Example |

Enter the information shown on the screen above |

Make any desired changes. Click on the next tab or press enter at the last field to go to the State/City w/h tab. For character, press <Enter> at Field number to change ? for the last screen:

Graphical Mode

Character Mode

Here, too, the requirements are generally the same as those for states, except that you enter city withholding figures instead of state figures.

City withholding allowance amt

Enter the city withholding allowance amount in the same way as the state withholding allowance amount was entered in the State withholding allowance amt field of the State tables.

|

Format |

99999.99 |

|

Example |

Type 600 |

This field is unique to city tax tables. If you want a specific city’s year-to-date CWT to be added to the state’s SWT for reporting purposes, enter two characters representing the state. The state entered must already have been entered in Master information (Tax tables).

If CWT is to be reported with SWT, all the tax code records for a particular city (for example, Fresno single, Fresno married, and Fresno head of household) should have this entry set the same, such as CA. Not doing so may produce unexpected amounts. In the State Tax Codes section, for the Include CWT in SWT for reporting field, be sure to check the box (enter the flag Y) — this will link the fields.

For example, New York State requires taxes withheld for New York City or Yonkers be included in the state’s Total tax withheld field on the annual, quarter-to-date forms or electronic reports.

|

Format |

Two-character state code |

|

Example |

Press <Enter> to leave blank |

These fields are entered in the same way as the corresponding state withholding table. See the State withholding table and federal Tax Tables.

There is a difference here from the state table using calculation P. If you are using calculation basis P for percent, you enter the percent of state withholding tax to take, not the percent of the federal withholding tax.

|

Format |

99999999.99- (for dollar amount) 99.99- (for percent) 99999999- (for on amount over) |

Example Enter the Detroit withholding table as it appears on the screen above.

Make any desired changes. Click on Save (press <Enter> at Field number to change ? in character) to conclude processing of this tax code.

The Federal and all State and City tax tables print.

Select

Select Tax tables from the Reports menu.

Select a printer. You may also select to view the report with html or PDF.

Click on Select to print the report or Cancel to return to the menu without printing.